What is a Convertible note and How to use it to raise capital for your Startup?

📖 Learning

Fundraising is the formal word for seeking funding to expand your business if you are a tech firm in its early stages. A convertible note is a financial tool that is most frequently suggested for this purpose. However, we must first comprehend equity to comprehend how those operate.

Here we have tried to explain the terms with certain examples and cases which would make it easier for you to understand. A hypothetical company named "Pitchify" with Sam and John as co-founders of this company is used in most of these examples and cases so that the flow of the article remains constant throughout.

So let's dive right in.

How does one define a Stock?

A priced round: Raising money for stock

What are convertible notes?

How does this process work?

Advantages

Drawback

How does one define a Stock?

The word "stock" is certainly somewhat known to you. Stock, which symbolizes a firm's ownership, is allocated in portions to indicate how much of the business each investor or owner owns. One or more shares of stock are distributed to each shareholder.

Percentage Ownership = No. of shares or equity / Total no. of shares issued

The acquisition of that ownership is frequently accomplished by a monetary commitment, but it is also possible through other types of value-added contributions, such as your diligent labor. An investor's claim to the firm's divided profits is typically determined by their ownership stake. The terms "dividends" and "voting power" are used concerning some important corporate decisions.

To help you understand, consider the startup "Pitchify". Let's assume that the company was founded by two individuals who shared the idea for the venture and gave their entire professional attention to its growth. As a result, they will be collaborators. Sam and John, the business' co-founders, officially incorporate it.

Typically, startups register with approximately 1,000,000 shares of equity. Why? The division of a share into halves is difficult. As a result, after the company is incorporated, each of the pioneers holds 5,000 shares of stock, which is equal to half of the company's total outstanding stock of 1,000,000.

The majority of startups are registered as Delaware C-Corporations. Investors are most accustomed to this type of legal arrangement since it is simple to set up, and maintain, and is also highly tax-friendly.

Now that we know what a stock is and certain terms related to it let us move on to something known as Priced Round right from the basics.

A priced round: Raising money for stock

A priced round is the conventional method for raising capital. referring to a round in which the founding members and the investors may reach a consensus on a fair company value and the investor receives shares of the company's equity in exchange for his participation.

Assume for a moment that Pitchify begins to operate, generate sales, and everything is going great. If they are making $10,000 per month in sales and subscriptions are increasing quickly, they might opt to raise capital.

They determine that they'll need to raise $500,000.00 in investment to grow their company, so they start looking for investors. Keep in mind that businesses rarely fundraise when they have no revenue. In return for that $500,000, how many shares do they issue to investors? The answer to that query truly has to do with business value. What is the worth of this company? For example, if Sam and John ran a car wash rather than Pitchify, their EBITDA would be multiplied by that amount to determine the business' value.

A typical firm might be worth up to twice as much as Sam and John's $10,000 monthly income ($120,000 annually), based on how productive they are. This implies that an investor may pay around $250,000 to purchase the entire car wash company (Excluding the value of the land or the building).

Tech startups, though, are unique. It's difficult to predict how quickly and how much tech firms' revenues and worth will increase because they may have great scale prospects and outstanding profitability.

For instance, a software product or app might theoretically provide minimum service to billions of clients worldwide. Consider Uber, which received $5,000 in the initial round and is today valued at about $80 billion.

They didn't have to spend billions of dollars, for instance, to purchase a fleet of cars. Because of this, the worth of a tech company is not closely correlated with its existing assets or sales, but rather with its potential growth, with its ability to develop and commercialize those ideas.

Here are some factors to consider:

- The size of the marketplace: How many potential clients does the company have, and what are their price preferences for this good or service?

- The technology – Is there a special device that no one else has or that significantly improves a procedure?

- Potential margins - what are the costs associated with serving an extra client? For instance, when Instagram had 300 million users, just 13 employees worked there. Nevertheless, none of these figures are certain; they are just estimations.

However, depending on them and some reliable early outcomes, the startup's worth is determined by the amount of potential an owner sees in the firm. How hazardous it is and how much gain do they anticipate in return for taking a chance with their investment?

Therefore, tech businesses like our hypothetical Pitchify would currently have an average pre-money valuation in Silicon Valley of roughly $4,000,000. I'm supposing once more that this is a large-scale, high-margin industry and not a car wash.

So, if Tom, our investor, agrees to these terms, he is prepared to invest $5,000,000 in our company by buying a $5,000,000.00 portion of it. If the total valuation is $4,000,000, then $5,000,000 represents approximately 11% of that value, according to plain math.

Just keep in mind that Sam and John each own 5,000 shares of this company. Tom will receive new shares from the firm instead of the usual practice of the existing shareholders transferring or selling their ownership.

If a company isn't genuinely acquired, equity rarely changes hands. Contrarily, businesses frequently reissue stock, which reduces the percent ownership held by the initial shareholders. The number of shares the firm will have after doing this will be 1,125,000 rather than 1,000,000.

Sam and John will still each own 5,000 shares, but their ownership percentage of the company will be closer to 44.4 percent rather than 50 percent. Tom now holds 11.11 percent of the firm's new 1,25,000 shares. Pitchify is currently valued at $4,00,000 post-money. And because of this, we initially issued 1,000,000 shares rather than fractional shares.

We would need to round up or down if the corporation had just 100 shares, for example, 50 for Sam and 50 for John. In such a case, Tom would have received 12 or 13 shares, depending on whether we're rounding up or down. Even though the roundup may no longer be valuable, the 0.01 percent equity position In a business like Uber, amounts to $8,000,000 in the present.

Today, the difficulty of conducting a priced round of fundraising is that there are several details to be determined, such as how many votes each share receives in various discussions. Typically, you get one vote per share, but since they will hold a minority of the corporation, investors frequently demand additional power over important corporate decisions.

Investors are compensated first in the event of a firm bankruptcy, for instance, if assets need to be sold. On a priced round, that is another point on which you must agree. What about the management board? In addition, shareholders will want to have power over a seat and safeguard themselves from removal from the board.

Because these choices call for negotiations, legal counsel, and the recording of signatures, the transaction may now take six months or longer than it would have otherwise. Since the majority of tech startups don't have six months, they frequently decide to use a convertible note.

Before that what exactly is a convertible note? How can one raise capital using that? After learning about what stock and a priced round are, can you take a wild guess?

Too many questions I suppose. But it's kind of fun this way!

I'll just explain it in the simplest terms. So moving on...

What are convertible notes?

A convertible note is a tool that postpones the valuation discussion, allowing the business and the investor to reach an agreement and proceed with the funding much more quickly, with less negotiation, and more affordable.

A convertible note functions somewhat similarly to a loan, except instead of utilizing an asset like a property as security, the business stock serves as the security at a future-determined valuation for the firm.

Since the investor intends to turn this note into genuine company stock, investing in a firm requires a belief on their part that the investment will be successful.

It might be difficult to define a company's valuation. The investor is essentially saying, "I'll offer you the money to grow now," using a convertible note since there are too many unknown variables and too little data available.

We must have the information necessary to sustain a priced, conventional funding round in around a year, at which point my contribution will be converted depending on the terms and enterprise value that the stakeholders define for such a later priced round.

As you can see, there may be various terms associated with convertible notes that are difficult to understand; thus, we will define each of them using cases.

So let's take our first case A:

Tom, the original investor, sends money to Sam and John on a convertible note. With the money, they expand as anticipated, and their firm appears to be in good condition and headed for great things. A year later, they can introduce a new investor named Peter, who is prepared to put in $1,000,000 for a round of funding that values the firm at $5,000,000.

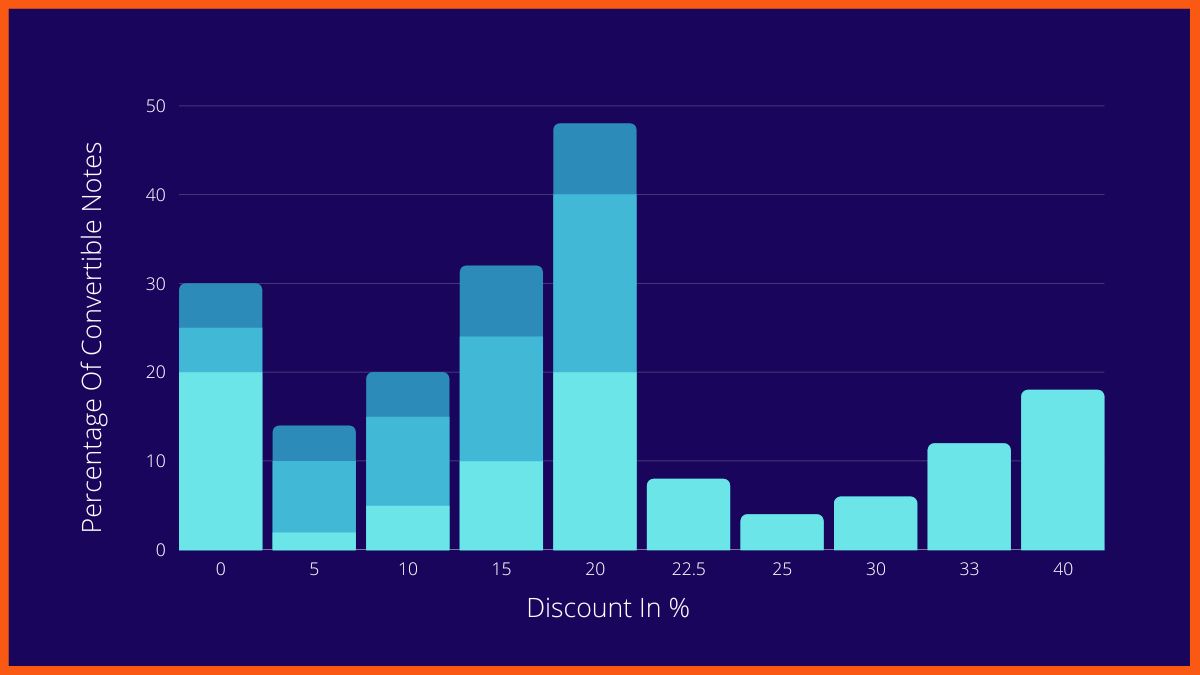

The convertible note with Tom is activated when this fresh investment is received. Notes have a rate of interest and a discount, but not to make up for the initial investors' belief in this enterprise. Typically, the discount is between 10 and 25 percent, while the interest rate is between 5 and 6 percent. That represents savings based on the new investor's valuation.

Again, in this instance, Tom made his investment a year earlier than Peter, earning him an interest of nearly $25,000. When the moment arises to finalize the legal documents, Tom would convert $5,25,000 at a $4MM valuation rather than the $5MM valuation Peter received (that is the 20% discount). Peter puts their $1 million into the $5 million valuation once the note converts.

Now moving on to the second case that is case B:

Here, the business expands incredibly quickly. Pitchify locates a potential investor in a few years who values the business at $50,000,000. Even at a 20% reduction, Tom's conversion valuation is $40,000,000, meaning that the initial $5,000 investment plus interest would represent less than 1.5 percent of the business.

Tom's risk-taking decision to invest initially was not paid for in this Pitchify venture. Nodes have a cap on their valuation because of this. The note will only convert at this cap's highest value.

Let's assume that $7MM was the agreed-upon investment cap in this scenario. So, while the shareholders make investments in a company with a $50,000,000 market value, Tom converts his note at the cap, earning a 6 x paper investment return. Which is rather good.

By the way, the same process will still be in place if the firm was successfully acquired. To become eligible to take part in the firm's sale, the convertible notes would transform.

Lastly, let’s look at Case C:

If the business is unable to secure more capital. Therefore, the convertible note has a maturity period if the firm is unable to gain momentum and draw in new investors. Holders of convertible notes may convert their notes and interest at their ceiling on or after this date, or they may seek repayment from the notes. Investors won't likely ask for a convertible note return unless the business can afford it. Additionally, they may think conversion at the cap is an extremely overpriced valuation for the firm as it stands now. The startup would likely need to declare bankruptcy if it cannot repay the notes when they are due and the financiers execute them. Due to the firm's lack of resources to repay the notes, the investors will likewise lose most of their funds. Using the same $500,000 scenario as before, Sam and John may not have been able to establish a solid product-market fit, but they are still bringing in, say, $500,000 annually. In these situations, the business and the holders of convertible notes settle on one of the options given. They are:

- Delay the notes' maturity date while they continue to accrue interest. This allows the firm to grow rapidly and possibly draw in a new round of funding in the coming years.

- Agree to a repayment schedule that requires the corporation to pay the notes over a predetermined length of time by making periodic installment payments rather than one large payment at the beginning. The firm can't stand to repay without going bankrupt.

How does this process work?

- Find out how much you'll need to raise. It costs approximately between $500 Thousand and $2 million. The lowest amount of capital you wish to solicit from investors. Consider that there are 4 separate investors, each of whom contributes $250,000. At least in terms of the funding round, you certainly don't live in an ideal world. What are you willing to accept? You'll come across a fair proportion of investors who are happy to write cheques between $5000 and $10,000 or who wish to invest at least $50,000. The point is whether you want to round up a dozen of those folks to get there. No, is the response. The cap table shouldn't be filled in that way because handling it would be more difficult.

- Certified investors should be informed of the terms of the convertible note. You ought to be able to rapidly come to an agreement with the investor on those conditions when the appropriate moment arises.

- The new purchase contract should be signed and dated. Since this is a secured note provided by the corporation rather than a contract, you are the sole person signing it.

- The note purchase contract will now be exchanged for the funds.

- The note holder ought to be listed in your cap table if he or she is not a shareholder but appears on the debt page cap table.

- It is a very short process and you could repeat it after months.

Advantages

Every financial instrument has some pros and cons. We'll first discover the pros of using Convertible notes or certain advantages they possess. Let us have a look at it. The following advantages or pros are taken into consideration:

- Valuation - gives you money while delaying the appraisal of your business. Due to your increased value and higher stock price, that convertible note will turn into fewer shares. You have less dilution.

- Legal cost - There are only a few documents in this collection. A questionnaire for accredited investors that asks them to certify that they are certified investors as well as the physical promissory note itself is usually required. The cost of the lawsuit is quite minimal. Since there are far more conditions to negotiate and since you normally pay legal fees each time you negotiate, doing an investment fund round includes far more and much lengthier documentation. Compared to a priced round, it costs much less.

Drawback

The same applies here. Every financial instrument has some pros and cons. We'll now explore the cons of using Convertible notes or certain disadvantages they possess. Let us have a look at it. The following drawbacks or cons are taken into consideration:

- Maturity Date – You will eventually have to choose between having the note raised, renegotiated, and renewed, or converted to equity at a quite low valuation. That is currently one of the benefits of the simple agreement for equity (SAFE). However, the investor benefits because he frequently enjoys the concept that there is a deadline that, if the firm hasn't delivered as predicted by that deadline, gives the investor some negotiation power over what follows next.

Conclusion

Therefore, a convertible note is a financial instrument with a discount, a cap, and an interest rate. The note is typically issued or activated with the closure of a new round of funding, upon the company's purchase, or at some other predetermined deadline or maturity time, which is frequently 18 or 24 months after the initial funding. Investors can now request a payback, convert the note at the cap, or negotiate a note extension, normally if the company can afford it.

These days, it is possible to acquire capital from investors for free thanks to documents developed by Y-Combinator and 500 firms that are even simpler to implement than the original convertible notes. You can acquire financing and save some money on legal fees by using the keep-it-simple security and the basic agreement for future equity. Both of them work once more as convertible notes, albeit with less red tape. In addition, the phrasing in both versions is identical. At this point, you ought to be able to comprehend them.

Whichever way you choose to raise capital ensure to align it with your business goals so it doesn't lead to any diversion from the vision or mission.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace