Niyo Money (Goalwise) vs Scripbox: The Top Online Mutual Fund Startups

🔍Insights

In the past few years, many online mutual fund investment portals like Niyo Money (Goalwise) and Scripbox have come about which have simplified the process of investing for individuals. This has been mainly beneficial for investors and now gone are the days where people don’t have to go bank branches in order to be able to invest in Online Mutual Funds.

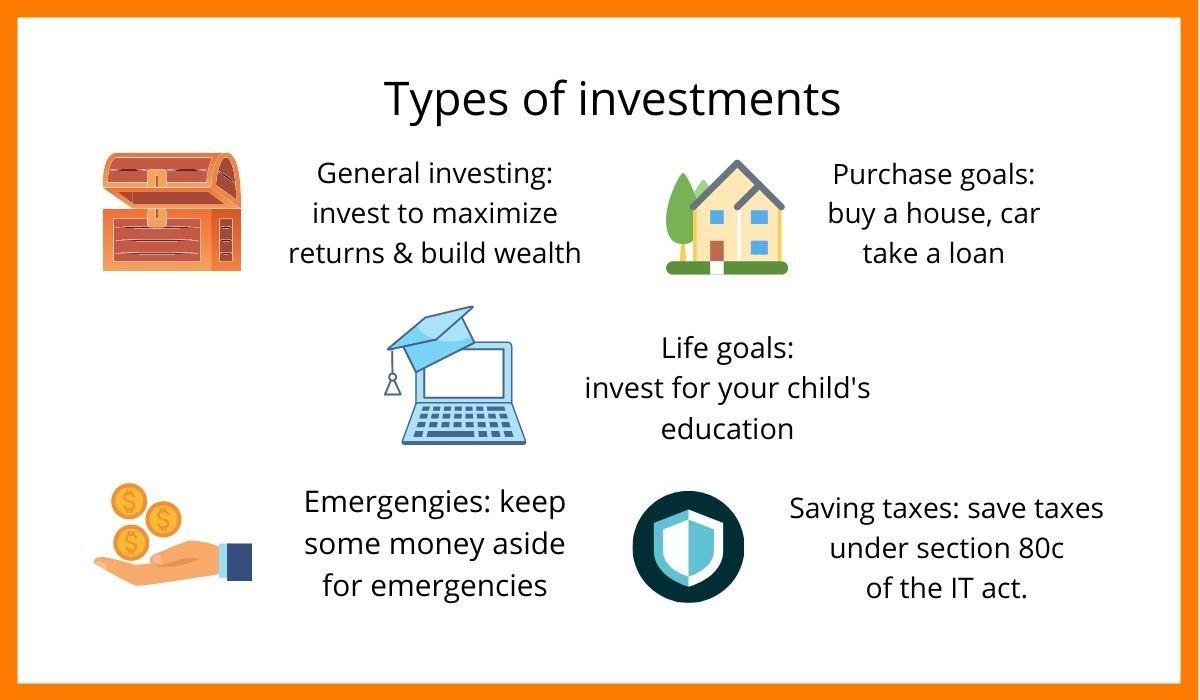

However, before you begin investing, you need to do research on which online mutual fund you want to invest in and think about the purpose of the investment and when you need the money back. Based on that, you need to know how much to invest in equity, how much in debt, and how all of this ties in with your financial goals in life. This article will help you choose a mutual fund platform according to your needs.

Benefits of Investing in Mutual Funds

Brief on Niyo Money (Goalwise)

Brief on Scripbox

Direct Mutual Fund Investment

Focused Mutual Fund Selection

Goal Based Investing

Glide Path Strategy

Ease to us

Transfer Plans

FAQ

Benefits of Investing in Mutual Funds

One of the key advantages of investing in a mutual fund is that each investor (even with a small investment) gets access to professional money management and expertise. Also, it would be very difficult for an investor to create a diversified portfolio of investments on his own with a small amount of money. With mutual funds, each investor participates proportionally in the return the scheme generates.

Each unit gets a proportional share of gain (or bears loss) from the fund. There is a portfolio report generated for each investor, which tracks all investments and the returns generated by the mutual fund. Investors can draw their money any time they want, also they can invest small amount.

Brief on Niyo Money (Goalwise)

Goalwise is an online wealth management platform that allows users to buy and invest in direct mutual funds. Goalwise headquarters is in Bengaluru, Karnataka. Goalwise has been a Subsidiary of Finnew Solutions Private Limited since July 2020. Goalwise has received a total of $1Million in funding. Goalwise main competition is Kuvera, Groww, and ETmoney.

Niyo Solutions acquired Goalwise in July 2020. The company plans to launch international and domestic stocks, Robo-advisory, and auto-invest products in the next few months. Now they have started offering zero commission investment.

It is a new age mutual fund investing platform which provides goal-based investing for investors looking to invest in direct mutual funds. With Goalwise one can easily set up SIPs or invest a large amount in the mutual funds chosen by its algorithms. If someone is a first-time investor looking to get started quickly as well as experienced investors looking for planning and automation.

The Goalwise app has features like automation in fund selection and switching, automation in asset allocation based on the goal time horizon. The app is also highly customization to suit the needs of every individual investor.

| Company Name | Goalwise |

|---|---|

| Headquaters | Bengaluru, Karnataka |

| Founded On | 2015 |

| CEO | Swapnil Bhaskar |

| Annual Revenue | $1.2M |

| Sector | Consumer Finance & Credit Cards |

Brief on Scripbox

Scripbox is an online platform that allows users to invest in mutual funds. Scripbox is headquarters in Bengaluru, Karnataka. The founder and CEO of Scripbox is Atul Shinghal, while the investors including Trusted Insight, Omidyar Network, and Accel Partners. Scripbox’s main competitors are FundsIndia, Fisdom, and Groww.

As of August 2019, Scripbox has 413.9 thousand fans on Facebook and 2.4 thousand followers on Twitter. Scripbox is a user-friendly app-based investment platform that makes investment completely hassle-free. One can start a SIP or make a one-time investment with the help of Scripbox. It is a great app for beginners as it also automates most of the investment process through its scientific and unbiased fund recommendation. It is the only app which has algorithm that reduces Long Term Capital Gain Tax at the time of withdrawal. Scripbox also generates capital gain tax statement that will us male tax return or annual IT return. Also they do not charge for services.

| Company Name | Scripbox |

|---|---|

| Headquaters | Bengaluru, Karnataka |

| Founded On | 2012 |

| CEO | Atul Shinghal |

| Annual Revenue | $1.5M |

| Sector | Consumer Finance & Credit Cards |

Direct Mutual Fund Investment

The mutual fund investment you do with the help of a broker or financial advisor includes an extra 1% which is paid to the broker or financial advisor. So some mutual fund plans are called regular plans. You should read about the expense ratio to learn how your broker, commission agent and distributor agent, and distributor make money when you invest in mutual funds.

With Goalwise, you will be investing only in direct mutual fund plans and will be earning an extra 1% on your overall investment. Scripbox however has an algorithm that creates a basket of ten mutual funds. The firm claims to make mutual fund investment simple and jargon-free for investors with no financial background. It also allows the customer can keep a check on their portfolio from their mobile or computer.

Focused Mutual Fund Selection

One of the challenges of mutual fund investing is to find the right mutual funds to invest in a lot of them are dependent on friends, network, and information on the web to find the right mutual fund. However, the bigger challenge is to know when to get out of a particular fund. Goalwise has a wide fund selection criteria and also tries to solve this problem by using data to suggest mutual funds.

When it comes to Scripbox it has more than 8000 choices in the market with seasoned investors which will give a tough time in deciding which to invest in. The Scripbox algorithms choose to perform mutual funds basis on their historical performance.

Goal Based Investing

Goal-based investing is one of the smartest ways to grow wealth and achieve all your life goals. A lot of the first time users are not aware of goal-based investing and they then focus on growing their money that is what Goalwise is known for as it is goal-based investing. When you tie up your investment with a goal, you are more likely to be happier.

Scripbox on the other side provides growth with the principle of safety. In scripbox money is first invested in liquid funds. A fixed portion from this is then invested each month in index funds. The benefits of this are:

- Security and stability similar to FDs

- Better taxation than FDs thanks to indexation

- Better returns than FDs

- Full flexibility to stop or withdraw anytime

Glide Path Strategy

The glide path formula is a methodology by which asset allocation is achieved as your portfolio changes every time. Let’s understand this with a simple example from Goalwise and Scripbox :

In Goalwise: One of your goals is to have 40 lakh for child education in the next 6 years. Based on your risk profile the initial investment will be 60% equity and 40% in debt instruments. All your SIP will be done to get exposure in the 60:40 ratio in the equity debt market.

By the final year, your exposure on Equity: Debt ratio would be 0:100%. This is to ensure your investment is safe from market volatility and you receive your goal amount, despite the market going down. Goalwise automates this process and makes it easier for you to maintain asset allocation based on your goal time frame.

Whereas at Scripbox they have a practical action plan in place to create your child’s college education fund. In Scripbox it starts out with the right Financial Goal where they will help you estimate the amount you will need for your goals taking inflation into consideration. After that, they will create a customized financial plan for your child’s college education.

This plan will be based on the type of college, start date, your current savings, and the potential increase in your income. It will then make the right investments by deciding on the right mix of investments that are suited for the customer’s goals and their personal preferences.

Ease to us

The best part about Goalwise apart from being free is, it requires only a one-time setup. It is a complete set it and forget it kind of system. You can revisit anytime and make changes if required. However, the best thing to do is to set it up once and keep investing.

With Scripbox it is one click investment where one can choose between SIP (systematic investment plan) and OTI (one-time investment) and invest in the recommended top mutual funds in India with a single click. You can stay on track with your investments and also inform you in case you need to change your selection.

Transfer Plans

In Scripbox if you want to invest a large amount in equity, If you want to invest a large amount in Equity, but also want to reduce the impact of volatility, this plan is ideal for you. Instead of keeping your large amount in your bank account, park it in liquid funds which grow 2-3% faster.

And most importantly it is flexible. You can stop, and restart, your STP at any time. In Scripbox the amount is fully invested into Liquid funds. Then, every month, a certain amount is moved from these Liquid funds into Equity funds.

The transfer plan in Goalwise allows you to switch from regular fund to direct fund. With Goalwise, you could track all your external investments and see which all regular funds you have invested in. You can also move all mutual funds investment to Goalwise.

So you decided to start using Goalwise and also move all your funds from other brokers/distributors to the Goalwise platform, you could do that with just a few clicks. If you ever feel you are stuck with your existing mutual fund advisor, a feature like this makes it easier for anyone to take control of their funds.

FAQ

Are the mutual funds picked by Goalwise and Scripbox always the most profitable ones?

Every fund selection process goes through underperformance. As these services use AI, the pick would be the most accurate one. But the stock market is highly volatile, nothing is predictable. There will be ups and downs in the short term.

What is mutual fund SIP?

A SIP or a Systematic Investment Plan allows an investor to invest a fixed amount regularly in a mutual fund scheme, typically an equity mutual fund scheme.

Which one is better Scripbox or Goalwise?

Goalwise provides you a goal-based investing and it takes no commission. There are no hidden charges and no account opening and managing charges as well. This means it is completely free. Other services like Scripbox use hidden charges to get money. So, Neo Money(Goalwise) is better.

How does wealth tech company make money?

They apply hidden charges, account opening, and managing charges. Also the premium plans.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace