Investment Options Tailored for Indian Investors

📖 Learning

The Indian economy boasts immense potential for wealth creation. With a burgeoning middle class and a rapidly growing GDP, the investment landscape offers a diverse range of opportunities. However, navigating these options can be daunting.

Understanding Your Investment Landscape

Risk and Return: A Balancing Act in the Indian Context

Investment Avenues Tailored for Indian Investors

Beyond Traditional Investments: Exploring New Horizons

Important Considerations for Indian Investors

Building a Winning Investment Portfolio - The Indian Way

Investing for Different Life Stages in India

Building Wealth in the Land of Opportunities

Understanding Your Investment Landscape

The Reserve Bank of India (RBI) reports that India's GDP is projected to grow at 7.2% in 2024-25. This optimistic outlook fuels investor confidence. However, inflation remains a key concern. A recent report by Reuters pegged India's retail inflation at 5.09% in February 2024. Beating inflation is crucial for growing your wealth in real terms.

Risk and Return: A Balancing Act in the Indian Context

Similar to global trends, Indian investments come with varying degrees of risk and return potential. Here's a breakdown of some popular options:

- Low Risk

- Fixed Deposits (FDs): Offered by banks and non-banking financial institutions (NBFCs), FDs provide guaranteed returns for a predetermined period. They are considered one of the safest investment options in India. However, FD interest rates may not always outpace inflation.

- Public Provident Fund (PPF): A government-backed scheme, PPF offers attractive interest rates with tax benefits. It has a 15-year lock-in period, making it suitable for long-term goals.

- Medium Risk

- Mutual Funds: Indian mutual funds offer a plethora of schemes catering to different risk profiles. Equity mutual funds invest in stocks, offering the potential for higher returns but also greater volatility. Debt funds invest in bonds and offer lower risk but steady returns. Balanced funds provide a mix of equity and debt, balancing risk and return.

- National Pension System (NPS): A voluntary pension scheme backed by the Government of India, NPS offers tax benefits and the potential for market-linked returns. However, there are restrictions on early withdrawal.

- High Risk

- Direct Equity: Investing directly in stocks of Indian companies allows investors to potentially benefit from company growth. However, individual stocks carry a significant risk of loss, and thorough research is crucial.

- Real Estate: Real estate in India has historically been a good wealth creator. However, it requires a high initial investment, and ongoing maintenance costs, and can be illiquid.

Investment Avenues Tailored for Indian Investors

Beyond traditional options, here are some investment opportunities specific to the Indian context:

- Sovereign Gold Bonds (SGBs): Issued by the Government of India, SGBs offer a safe way to invest in gold while earning interest. They are denominated in grams of gold and come with a fixed interest rate.

- Real Estate Investment Trusts (REITs): A relatively new option in India, REITs allow investors to invest in income-generating commercial real estate properties without the hassles of direct ownership.

- Peer-to-Peer (P2P) Lending: Online platforms connect borrowers and lenders directly, enabling investors to potentially earn higher returns than traditional savings accounts. However, P2P lending carries inherent risks associated with loan defaults.

Beyond Traditional Investments: Exploring New Horizons

The Indian investment landscape is constantly evolving. Here are some emerging trends to consider:

- Robo-advisors: These automated platforms are gaining traction, offering affordable investment management services through algorithms tailored to individual goals.

- Micro-investing Apps: These apps allow investors to start investing in small amounts, making the market more accessible, especially for younger generations.

- Gold Savings Schemes: Offered by banks and jewelers, these schemes allow for regular investment in gold, accumulating the metal over time.

Important Considerations for Indian Investors

- Taxation: Understanding the tax implications of different investments is crucial. Tax-advantaged options like PPF and Equity Linked Savings Schemes (ELSS) can help maximize returns.

- Investment Horizon: Matching your investment choices to your financial goals' timeframes is essential. Long-term goals are better suited for riskier, growth-oriented investments, while short-term needs may benefit from safer options.

Building a Winning Investment Portfolio - The Indian Way

Here are some key steps to navigate the Indian investment landscape:

- Know Your Risk Tolerance: Assess your comfort level with risk and choose investments that align with your risk profile.

- Set SMART Goals: Define Specific, Measurable, Achievable, Relevant, and Time-bound financial goals to guide your investment decisions.

- Seek Professional Guidance (Optional): Consider consulting a SEBI-registered investment advisor (RIA) who can create a personalized investment plan based on your specific needs and risk tolerance.

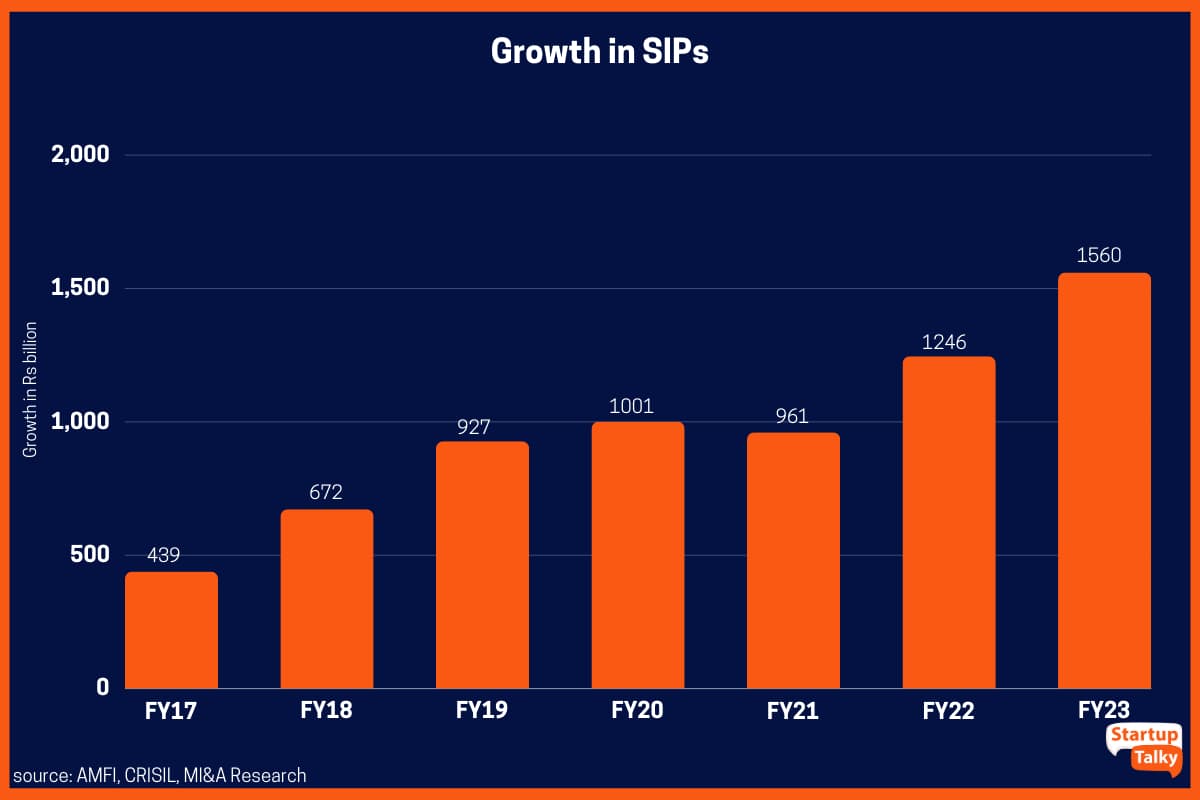

- Start Early and Invest Regularly: The power of compounding interest is particularly beneficial in the long term. Start investing early, even with small amounts, and contribute regularly using tools like Systematic Investment Plans (SIPs) in mutual funds.

- Diversify, Diversify, Diversify: Spread your investments across different asset classes like equity, debt, real estate, and gold. This helps mitigate risk and ensures your portfolio is not overly reliant on the performance of any single asset.

- Review and Rebalance: Periodically review your portfolio performance and rebalance it as needed to maintain your target asset allocation. This ensures your portfolio stays on track with your goals.

- Stay Invested for the Long Term: The Indian stock market, like any other, experiences periods of volatility. When the market goes down, don't rush to sell your investments out of fear. Stick to your long-term plans and don't let your market emotions drive sudden decisions.

Investing for Different Life Stages in India

Here's a glimpse into how your investment strategy might evolve throughout your life:

- Young Investors (20s-30s): You have a long time horizon to ride out market fluctuations. Focus on growth-oriented investments like equity mutual funds and direct equity (with proper research) to capitalize on long-term market growth. However, don't neglect some lower-risk options like PPF for stability.

- Mid-Career Investors (30s-40s): As you reach your peak earning years, you might have the ability to increase your investment contributions. Maintain a balance between growth and income-generating investments like dividend stocks and debt funds to build your corpus and generate regular income.

- Pre-Retirees (40s-50s): Your focus should gradually shift towards income and capital preservation. Invest in a higher proportion of bonds, government schemes like PPF, and dividend stocks for reliable income streams. Consider including some gold in your portfolio to hedge against inflation.

- Retirees (60s onwards): Your portfolio should prioritize income security. Invest in a mix of income-producing assets like senior citizen savings schemes, annuity plans, and some low-risk debt funds. This ensures a steady stream of income in your golden years.

Building Wealth in the Land of Opportunities

India offers a vibrant investment landscape with immense potential for wealth creation. By understanding your risk tolerance, setting clear goals, and choosing the right investment avenues, you can navigate your investment journey successfully. Remember, a disciplined approach, regular investment, and a long-term perspective are key ingredients for building a secure financial future in India.

FAQs

What are the new emerging trends that can be considered to make investments?

Robo-advisors, micro-investing apps, and gold-saving schemes are the emerging trends in making investments.

What is the risk involved in the National Pension Scheme?

The National Pension Scheme is a voluntary pension scheme backed by the Government of India. It offers tax benefits and the potential for market-linked returns. However, there are restrictions on early withdrawal.

What can be the investment strategy for a mid-career investor who is in their 30s-40s?

In your 30s-40s, boost investments wisely. Mix growth and income options like dividend stocks and debt funds for steady wealth growth and regular income.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace