Top 9 Digital Lending Companies in India

Collections 🗒️

When it comes to managing expenses and bills, especially when one has low funds. This becomes really pressurizing and people start looking for sources to lend money from. In such situations, borrowing from friends and family could be embarrassing and hectic. And depending upon banks could cost major interests. So where should we look?

Well by acknowledging these situations and deals, online money lending apps are developed. These provide the facility to lend money through digital platforms without any further issues.

Multiple companies are providing the facility of offering loads immediately with minimal competitive interest rates and required tenure durations. These companies facilitate the loan very easily and quickly as compared to usual bank loans.

With keeping such progress in mind, India has developed numerous digital lending companies whose finances can manage smoothly. India is evolving to a great extent in the digital sector and financial inclusion. The country has cash for transactions. But with the evolving method of development and modernization, India is shifting toward a cashless economy. To understand its development more prominently, let's look at the top 10 digital lending platforms in India.

1. Lendingkart

2. Pine Labs

3. MobiKwik

4. Shiksha Finance

5. MoneyTap

6. Paytm

7. PolicyBazaar

8. Capital Float

9. Faircent

1. Lendingkart

Loan Amount: Upto ₹ 1 crore

Loan Tenure: 36 months

The prominent digital lending platform, Lendingkart was founded in 2014. It works by offering different capital loans and company loans vary from small to medium-sized businesses across India. They are widely famous for providing capital completely through an online platform and require minimum documentation for the procedure to begin.

For young entrepreneurs, managing their finances becomes quite hectic and it deviates them from focusing on their business growth. That's why Lendingkart has taken the initiative to make capital funding easily available for entrepreneurs so they don't have to worry about the cash-flow gaps. Lendingkart is a company established in Ahmedabad, Mumbai and Bangalore. But, its services are accessible throughout the whole of India.

2. Pine Labs

Loan Amount: From ₹ 25,000 to ₹ 5 lakhs

Loan Tenure: 90 days

Pine Labs is one of the leading fintech companies in India established in 1998 that provides digital lending services. The company is quite famous for its incredible facility of transforming the mobile NFC into a card machine and activating the service of accepting all types of payment digitally which also includes the ‘Tap n Pay’ card as well.

Pine Labs have brought tons of services for the retailers including multi-channel, different payment options, brand offerings, risk assessments, analytics, and many more.

It provides working capital loans for small to medium businesses. Their loan application process is quite simple and you can apply for a business loan through their website or their app myPlutus.

Pine Labs' services and technologies are widely preferred and used by more than 100,00 merchants all across India and also, many Asian companies. According to the estimations, PineLabs’ cloud-based technology has the power of over 350,000 PoS terminals; that too in more than 3,700 cities.

3. MobiKwik

Loan Amount: Upto ₹ 5,00,000

Loan Tenure: -

MobiKwik is a very prominent mobile payment company that works by connecting the consumers together with the merchants and many online sellers. The company is established in Gurgaon, Haryana, India.

Mobikwik is a private company that has more than 550 employees. Since the establishment of this company, the company has raised a total of 118 million USD from over 8 funding rounds.

Mobiwik provides instant personal loans. You can download its app and once the loan is approved it will be credited to your wallet.

4. Shiksha Finance

Loan Amount: Upto ₹ 50,000

Loan Tenure: -

One of the biggest lending companies, Shiksha Finance, is an education-based finance firm. Shiksha Finance provides the services of funding parents for school fees by reducing the school drop-out rates. It also offers capital to educational institutions for the development of buildings, properties and working capital.

Shiksha Finance has loans that range from ₹ 10,000 to ₹ 50,000 with a return duration of 6 to 10 months. The loans which Shiksha Finance provides can be utilized for educational based purposes such as school fees, tuition, luggage and stationary.

5. MoneyTap

Loan Amount: Upto ₹ 5,00,000

Loan Tenure: 36 months

The Bengaluru based lending company, MoneyTap is known for its huge service of offering credit lines for the consumers as their loans, with the partnership with RBL Bank. MoneyTap is now counted among the leading lending businesses. Recently, the company received the license of NBFC for co-lending space together with their lending partners.

MoneyTap has offered many great features among which, the minimal documentation procedure for a personal loan is the most special one. Moreover, its app version also provides the facilities for tracking down your borrowing records.

6. Paytm

Loan Amount: Upto ₹ 2,00,000

Loan Tenure: -

The biggest digital lending wallet company Paytm is wildly famous in the minds of Indians. The company is established in Noida, Uttar Pradesh. Paytm has grown to a great extent and now, millions of downloads have been made.

The development the company has received is breathtaking. It employs more than 9000 people and has a revenue of a total of $118 million. Paytm is highly specialised in online shopping as well.

The company was founded in the year 2010 by Vijay Shekar Sharma.

7. PolicyBazaar

Loan Amount: ₹ 40,00,000

Loan Tenure: Upto 7 Years

The company is counted among the top leading online insurance companies, PolicyBazaar was established in the year 2008 and headquartered in Gurgaon, Haryana, India.

It is online life insurance as well as a general insurance aggregator company. PolicyBazaar is very popular among Indians for its incredible services and holdings. It employs over 2500 people and has an annual revenue of $21 million (as estimated in 2017-18).

The current CEO of PolicyBazaar is Yashish Dahiya who is also one of the founders of this company. It has raised around US$ 346 million through 7 funding rounds.

8. Capital Float

Loan Amount: ₹ 50,00,000

Loan Tenure: Upto 36 months

Capital Float is one of the leading lending companies in India. It is acquired by CapFloat Financial Services. Capital Float is popular for its amazing service of specialised financial loans and business credits.

Capital Float has a partnership with some prominent companies such as Shopclues, Paytm and Uber. The company lends the potential borrower through its system of proprietary loans. Capital Float is now targeting established store owners and small merchants.

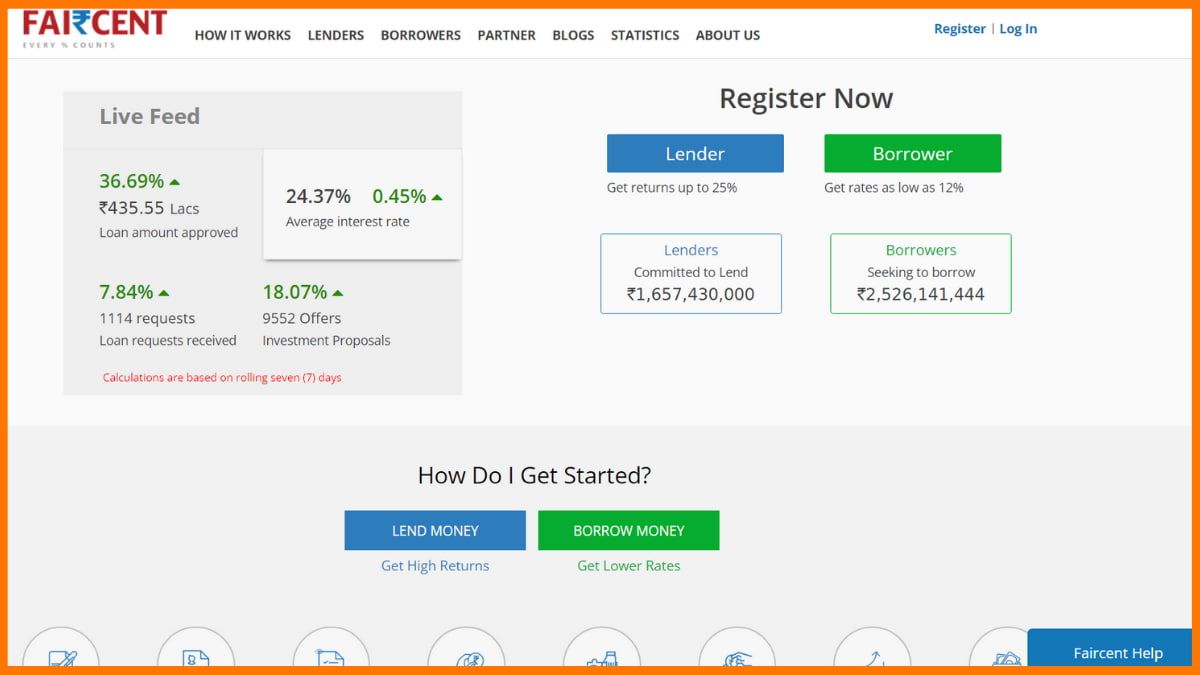

9. Faircent

Loan Amount: ₹ 5,00,000

Loan Tenure: -

The largest and first Indian peer-to-peer digital lending platform, Faircent is known to be absolutely amazing. It is officially registered by the RBI. It provides a safe marketplace for people to loan money to a borrower. Faircent facilitates the credit to organizations and individuals who are interested in lending money.

Faircent provides the absolutely convenient procedure of lending the required money to those who need it, at reasonable interest rates.

Conclusion

In India, there are many fintech companies that are providing the service of digitally lending money very easily with the minimal documentation procedure. Today, many apps have been developed by these companies to make the transaction of money absolutely susceptible. And for those who require a personal loan or business loan, can easily get one. That's why we listed these top digital lending companies in India.

FAQs

What are some of the top digital lending companies in India?

Lendingkart, Pinelabs, Mobiwik, Policybazaar, and Paytm are some of the top digital lending companies in India.

How does a lending company work?

Lending companies provide loans to an entity, which is then expected to repay its debt.

How many fintech companies are there in India?

There are around 2,000 fintech companies in India.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace